Case StudiesBancassurance

A Leading Japanese Bank's Digital Insurance Integration Success with InsureMO

A leading Japanese bank partnered with InsureMO to seamlessly integrate and personalize insurance offerings across its digital apps, resulting in enhanced customer engagement and satisfaction. This collaboration positioned the bank as a pioneer in innovative financial solutions.

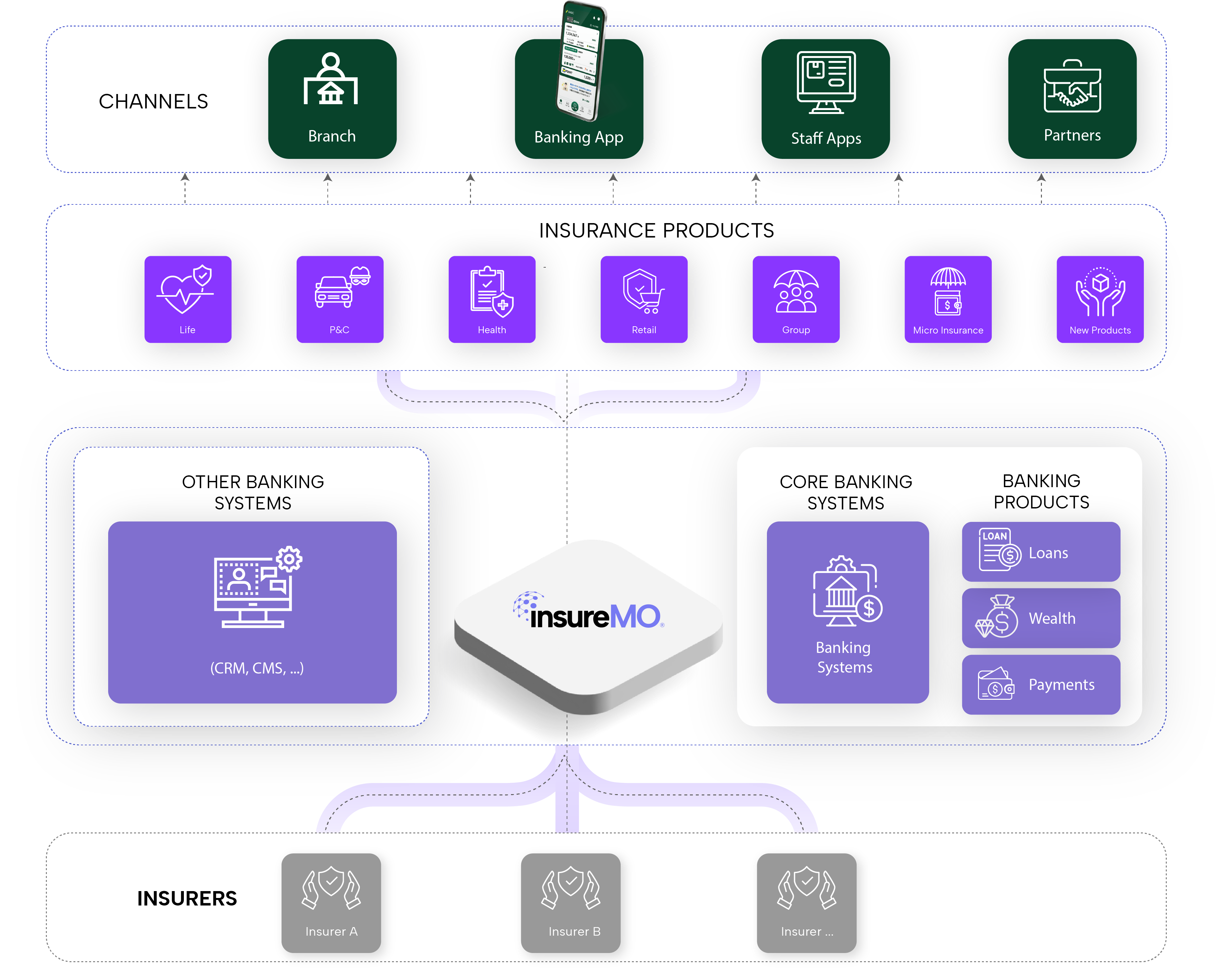

A leading bank in Japan and a global financial leader sought to enhance its insurance offerings across its flagship apps—one for banking customers and another for credit card users. To achieve this, the bank partnered with InsureMO, an innovative insurance middleware platform.