Crie qualquer Aplicativo, Lance qualquer Produto, Conecte-se a qualquer Canal

InsureMO permite que seguradoras, corretores e insurtechs inovem mais rápido com 17.500+ produtos, 10.000+ APIs e conectividade sem interrupções em todo o ecossistema.

Potencializando Seguros para Ecossistemas Dinâmicos

Habilitando Seguradoras e Mercados Verticais a Revolucionar a Distribuição de Seguros

Transformação de Seguros Impulsionada por IA

Capacitando Agentes Inteligentes com Modelos Ajustados e Tomada de Decisões Baseada em Conhecimento

InsureMO é a maior plataforma de middleware do mundo, habilitando grandes ecossistemas de seguros

0B$

0+

0+

0+

Crie & Conecte

Confiada por seguradoras, corretores, MGAs e parceiros tecnológicos para impulsionar a inovação e ampliar ecossistemas digitais.

"Choosing InsureMO as our mid-office platform is a significant step in Oona's digital transformation journey. Their capability to seamlessly create and connect diverse distribution channels gives us an edge, allowing us to accelerate our time to market for new and existing products. This partnership isn't just about technology—it's a partnership towards creating an insurance-as-a-service model for future-ready insurance carriers."

Abhishek Bhatia

Founder and Group CEO

Oona

"InsureMO has achieved significant recognition by receiving 7 AWS Service Ready Certifications, i.e. Graviton Ready, Lambda Ready, Linux Ready, PrivateLink Ready, RDS Ready, CloudFront Ready and WAF Ready within one year, reflecting InsureMO's commitment to innovation and its ability to provide best practices, robust product offerings, and cost-effective solutions to the financial service industry."

Bob Zhang

Solution Architect Manager, Financial Industry

AWS

"To achieve our vision of providing insurance and medical services to every 'member of the family,' we are pursuing to redefine established practices with technology as the foundation — innovating the value we can deliver to our customers. We adopted InsureMO, an InsurTech PaaS (Platform as a Service) because of its advanced microservices architecture and proven overseas use cases."

Kazuhiko Itaya

President

Little Family Small-Amount Short-Term Insurance

"The situation of the core system varies by insurance company, but InsureMO minimizes the impact of that core system and flexibly responds to the touch points with end-users such as policyholders and insurers in a relatively short period of time and at low cost. I think that's what we're providing value."

Ando Akihiro

General Manager, Insurance IT Service Division

NTT Data

"We at SBI General, have always been at the forefront of digitization. We meticulously choose and work with our tech partners to ensure that we provide our distributors and end customers with the most effective, innovative latest state of art technology solutions through their preferred modes and platforms. Our partnership with InsureMO is one of such initiatives in this direction."

Anand Pejawar

Deputy Managing Director

SBI General Insurance

"

"The synergy between Qantev and InsureMO is a new era for the insurance industry. By combining our Claims AI expertise with InsureMO's insurance platform, we are setting a new standard for what is possible when it comes to transforming insurance operations and customer service. This partnership is a step forward in our mission to enhance the performance of health and life insurers around the globe using cutting-edge AI."

Tarik Dadi

CEO

Qantev

"We are thrilled to unveil this strategic partnership with InsureMO. This collaboration is a giant leap toward revolutionizing the insurance sector. Together, we leverage the transformative potential of low-code technology to fuel innovation and set unprecedented industry benchmarks."

Rajvinder Singh Kohli

Senior VP and Head of Global GSI

Newgen

“Leveraging InsureMO, Chubb is able to further enhance our digital customer experiences by offering more customized products across SEA market in a much more cost-effective and efficient manner and to greatly expand our distribution networks by embedding insurance into more affinity partners’ ecosystems/user journeys. InsureMO, as a middle office layer, enables us to integrate with latest AI apps/capabilities while keeping our core policy admin system secure and stable.”

Ravindra Venisetti

Global CTO

Chubb Life

"The InsureMO platform is used successfully by insurers, brokers, agents and affinity channels, and our combined solution will ensure their rating requirements will continue to be fulfilled as markets become increasingly competitive and in need of agile and sophisticated pricing strategies".

Andrew Harley

Director

Willis Towers Watson (WTW)

“The partnership with InsureMO marks an important milestone in our transformation journey and is a significant step toward our goal of making insurance more accessible, efficient, and customer centric. By leveraging cutting-edge technology, we will empower our distribution channels, enhance customer interactions, and ensure scalability across our key markets.”

Andrew Lim

CEO

UOI

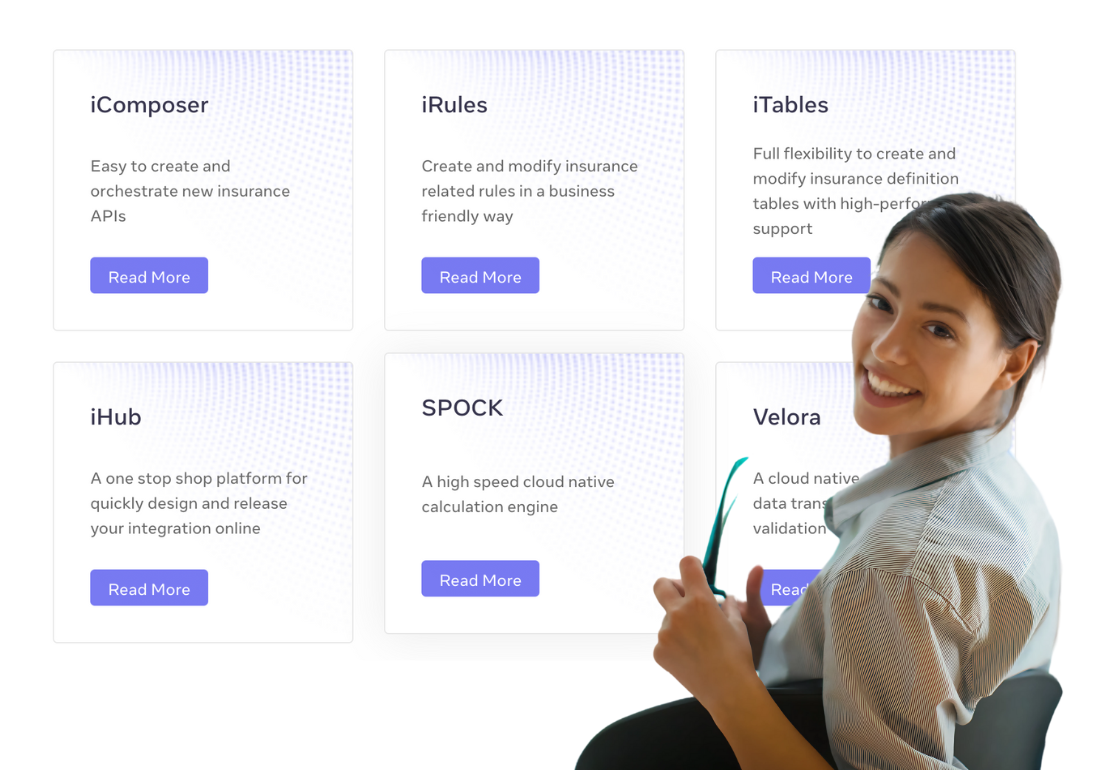

Uma nova forma de pensar na infraestrutura de seguros

InsureMO é uma Plataforma como Serviço (PaaS) completa com produtos, APIs e dados essenciais para impulsionar o seu crescimento.

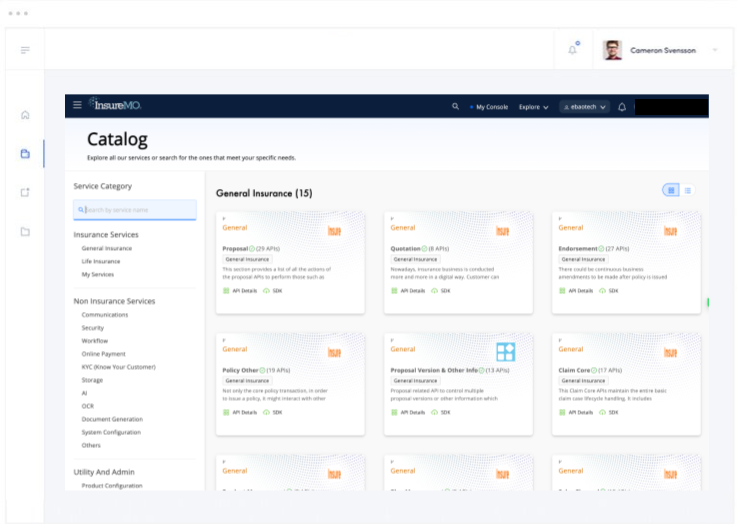

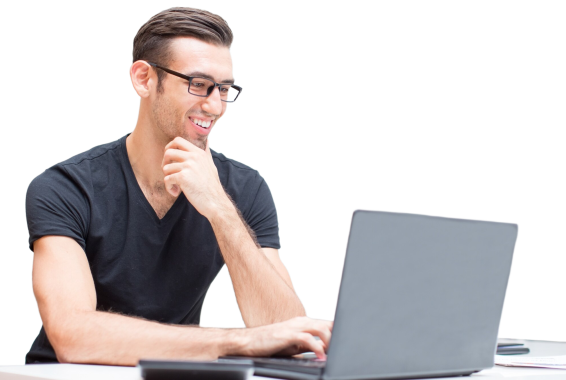

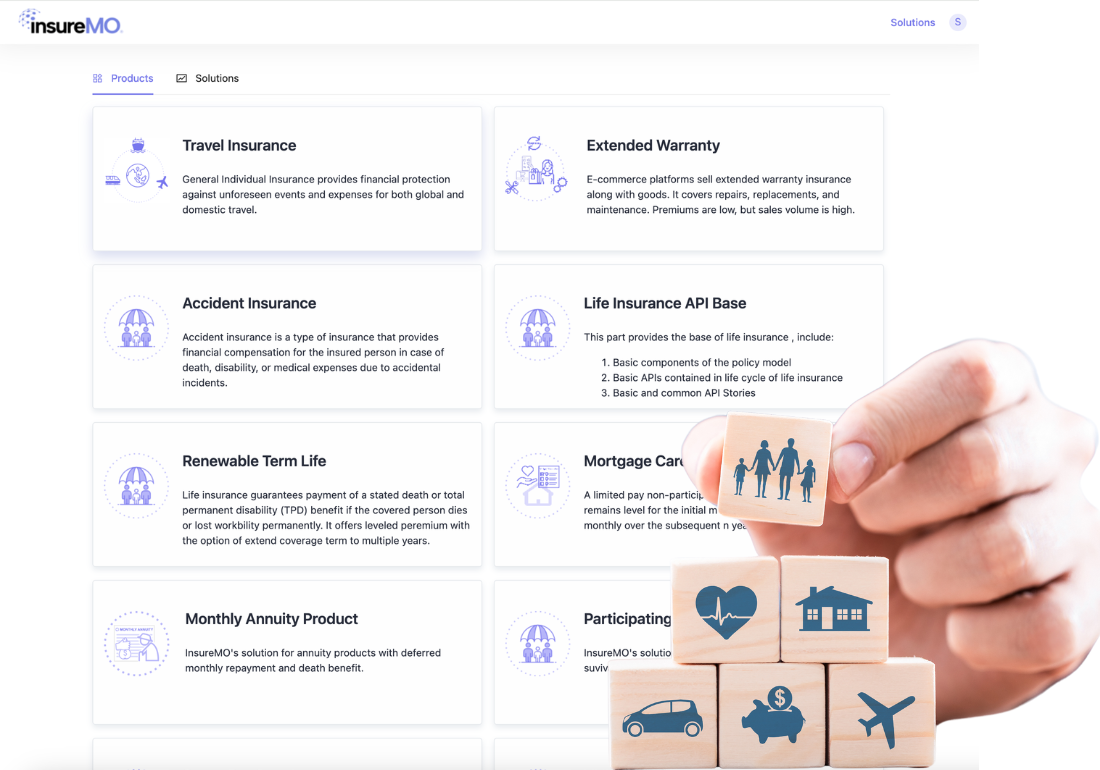

Bibliotecas de Produtos de Seguro

Acesse mais de 17.500 produtos de seguro pré-construídos. Personalize e lance ofertas regionalmente adaptadas rapidamente.

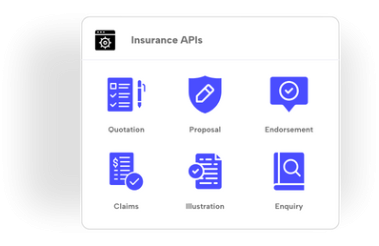

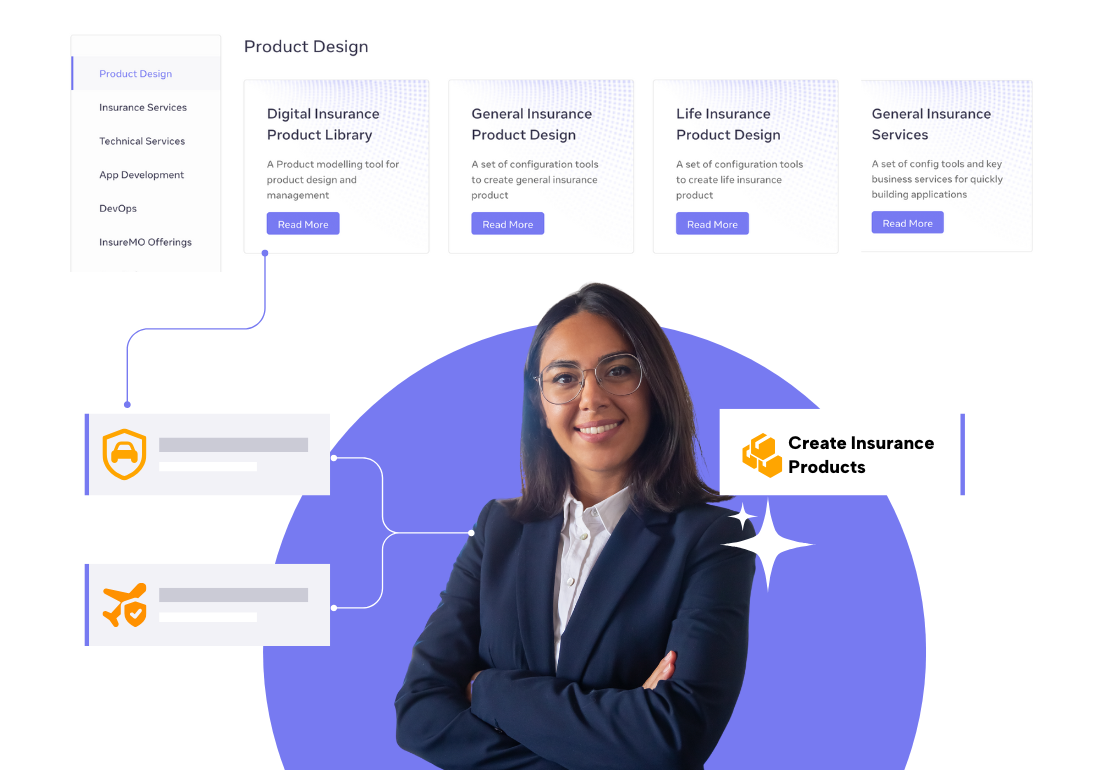

APIs de Seguro e Não Seguro

Utilize mais de 10.000 APIs que suportam todo o ciclo de vida de apólice em setores de seguro de vida, geral e saúde.

Administração e Utilitários

Plataforma abrangente orientada por UI para criação e gerenciamento eficiente de carteiras de seguros diversas

Revolucione suas operações de seguro com IA

Descubra como proteger seu negócio na era da automação inteligente

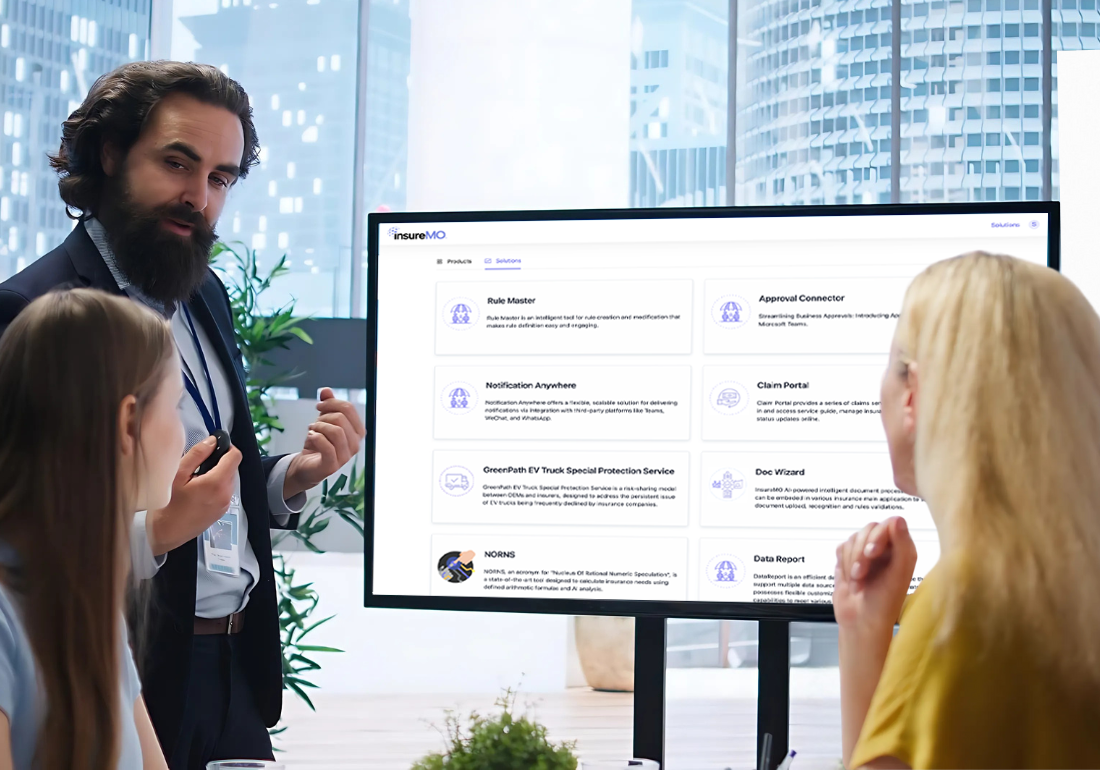

Transforme suas operações de seguro com nossa plataforma Open API

InsureMO ajuda seguradoras a modernizar sistemas core, habilita soluções de seguro conectadas.

Desenvolvimento Rápido

Desenvolva e implante rapidamente novos produtos de seguro com nosso ecossistema de APIs

Crie Soluções Personalizadas

Aproveite nossas APIs para criar soluções de seguro personalizadas adaptadas às suas necessidades

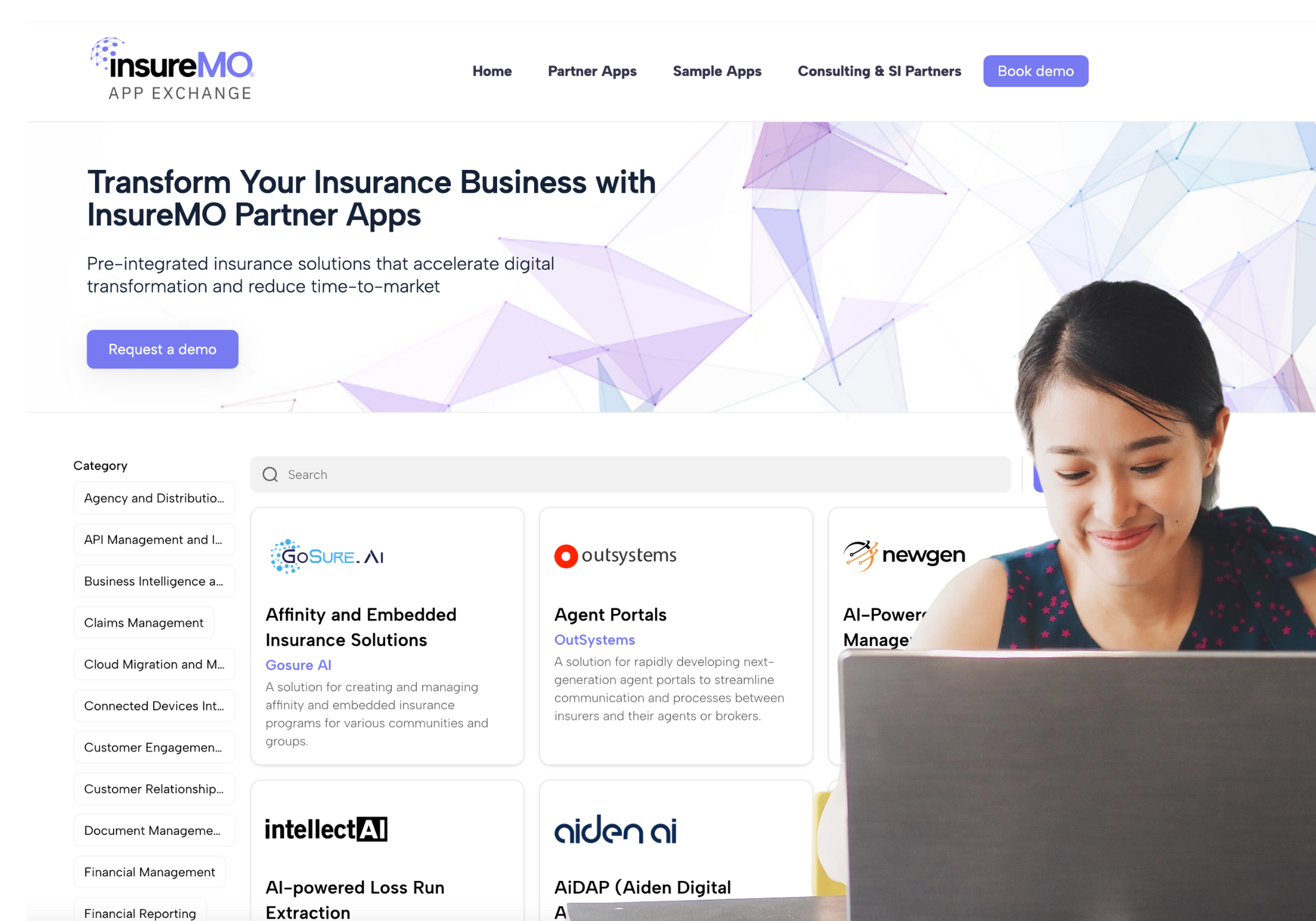

Use Aplicativos de Parceiros

Conecte-se com nosso crescente ecossistema de Parceiros de Aplicativos

Impulsionando a Inovação em Seguros

A InsureMO, com mais de 10.000 APIs, permite modernização de sistemas, integração de ecossistemas e inovação orientada por IA, transformando operações de seguros em larga escala.

Inovação Rápida e Agilidade no Lançamento

Com uma biblioteca de mais de 10.000 APIs e 17.500+ produtos prontos, a InsureMO permite que seguradoras lancem novas ofertas em semanas, não meses. Isso acelera a inovação e garante vantagem competitiva.

Arquitetura Escalável e Cloud-Native

Baseada em microserviços, API-first, cloud-native e headless (MACH), a InsureMO processa grandes volumes de transações com alta velocidade e eficiência. Sua solução cresce junto com as necessidades do seu negócio.

Conectividade Completa de Ecossistemas

A InsureMO conecta você a qualquer ecossistema, de Auto & Mobilidade a Saúde e Viagens. Essa conectividade permite criar ofertas sofisticadas e ampliar seu alcance de mercado.