Power any App,

Launch any Product, Connect any Channel

InsureMO enables insurers, brokers, and insurtechs to innovate faster with 17,500+ products, 10,000+ APIs, and seamless connectivity across ecosystems. Transform legacy systems and scale your digital insurance strategy globally.

InsureMO: Enabling Carriers and Vertical Markets to Revolutionize Insurance Distribution

Powering Insurance for Dynamic Ecosystems

API. Data. AI.

The Foundation of Modern Insurance.

Unifying connectivity, intelligence, and automation to power faster launches, smarter decisions, and scalable growth.

AI-Driven Insurance Transformation

Empowering Intelligent Agents with

Fine-Tuned Models and

Knowledge-Based Decision Making

InsureMO is the world's largest middleware platform

enabling large insurance ecosystems

0B$

0+

0+

0+

Create & Connect

Trusted by insurers, brokers, MGAs, and tech partners to power innovation and scale digital ecosystems.

"Choosing InsureMO as our mid-office platform is a significant step in Oona's digital transformation journey. Their capability to seamlessly create and connect diverse distribution channels gives us an edge, allowing us to accelerate our time to market for new and existing products. This partnership isn't just about technology—it's a partnership towards creating an insurance-as-a-service model for future-ready insurance carriers."

Abhishek Bhatia

Founder and Group CEO

Oona

"InsureMO has achieved significant recognition by receiving 7 AWS Service Ready Certifications, i.e. Graviton Ready, Lambda Ready, Linux Ready, PrivateLink Ready, RDS Ready, CloudFront Ready and WAF Ready within one year, reflecting InsureMO's commitment to innovation and its ability to provide best practices, robust product offerings, and cost-effective solutions to the financial service industry."

Bob Zhang

Solution Architect Manager, Financial Industry

AWS

"To achieve our vision of providing insurance and medical services to every 'member of the family,' we are pursuing to redefine established practices with technology as the foundation — innovating the value we can deliver to our customers. We adopted InsureMO, an InsurTech PaaS (Platform as a Service) because of its advanced microservices architecture and proven overseas use cases."

Kazuhiko Itaya

President

Little Family Small-Amount Short-Term Insurance

"The situation of the core system varies by insurance company, but InsureMO minimizes the impact of that core system and flexibly responds to the touch points with end-users such as policyholders and insurers in a relatively short period of time and at low cost. I think that's what we're providing value."

Ando Akihiro

General Manager, Insurance IT Service Division

NTT Data

"We at SBI General, have always been at the forefront of digitization. We meticulously choose and work with our tech partners to ensure that we provide our distributors and end customers with the most effective, innovative latest state of art technology solutions through their preferred modes and platforms. Our partnership with InsureMO is one of such initiatives in this direction."

Anand Pejawar

Deputy Managing Director

SBI General Insurance

"

"The synergy between Qantev and InsureMO is a new era for the insurance industry. By combining our Claims AI expertise with InsureMO's insurance platform, we are setting a new standard for what is possible when it comes to transforming insurance operations and customer service. This partnership is a step forward in our mission to enhance the performance of health and life insurers around the globe using cutting-edge AI."

Tarik Dadi

CEO

Qantev

"We are thrilled to unveil this strategic partnership with InsureMO. This collaboration is a giant leap toward revolutionizing the insurance sector. Together, we leverage the transformative potential of low-code technology to fuel innovation and set unprecedented industry benchmarks."

Rajvinder Singh Kohli

Senior VP and Head of Global GSI

Newgen

“Leveraging InsureMO, Chubb is able to further enhance our digital customer experiences by offering more customized products across SEA market in a much more cost-effective and efficient manner and to greatly expand our distribution networks by embedding insurance into more affinity partners’ ecosystems/user journeys. InsureMO, as a middle office layer, enables us to integrate with latest AI apps/capabilities while keeping our core policy admin system secure and stable.”

Ravindra Venisetti

Global CTO

Chubb Life

"The InsureMO platform is used successfully by insurers, brokers, agents and affinity channels, and our combined solution will ensure their rating requirements will continue to be fulfilled as markets become increasingly competitive and in need of agile and sophisticated pricing strategies."

Andrew Harley

Director

Willis Towers Watson (WTW)

“The partnership with InsureMO marks an important milestone in our transformation journey and is a significant step toward our goal of making insurance more accessible, efficient, and customer centric. By leveraging cutting-edge technology, we will empower our distribution channels, enhance customer interactions, and ensure scalability across our key markets.”

Andrew Lim

CEO

UOI

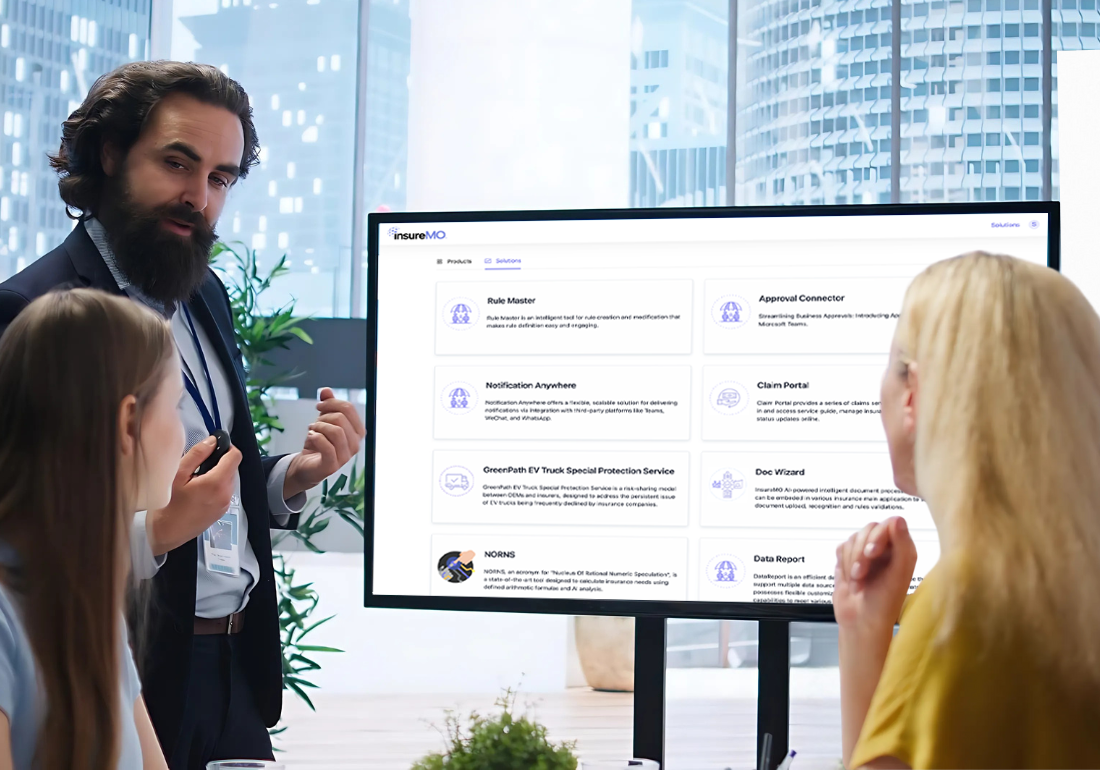

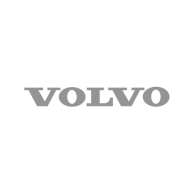

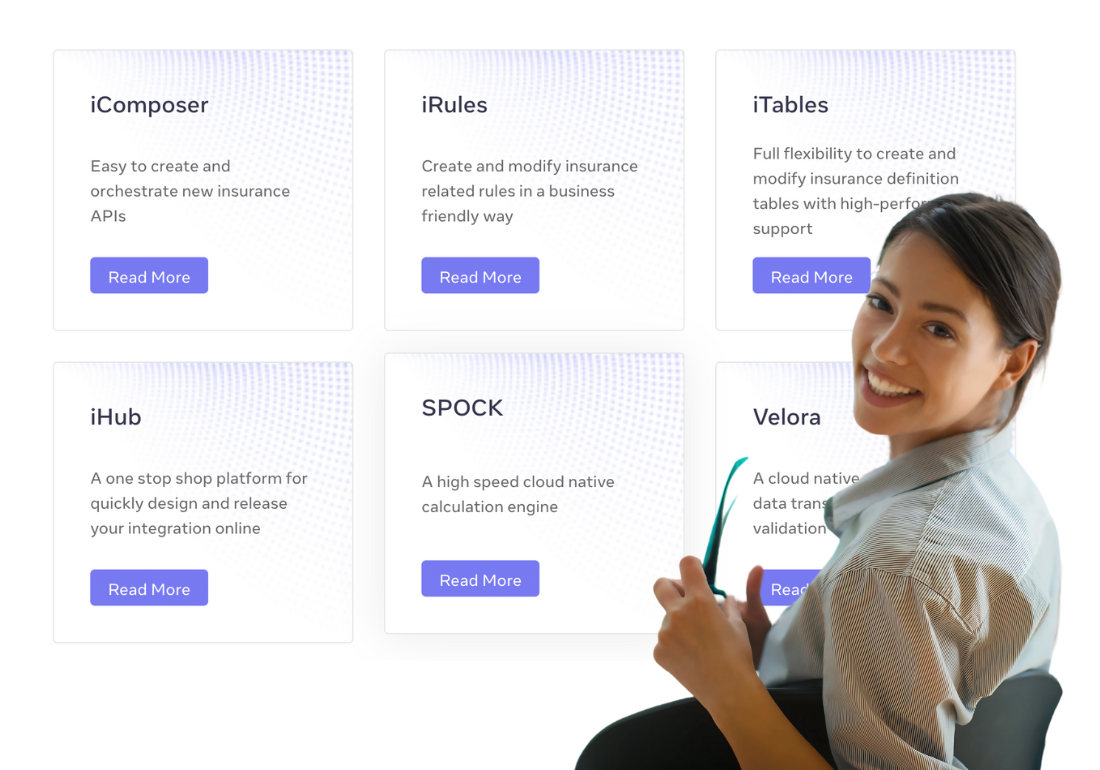

A whole new way to think about insurance infrastructure

InsureMO is a complete Platform As A Service (PAAS) across products, APIs and data essential to drive business growth.

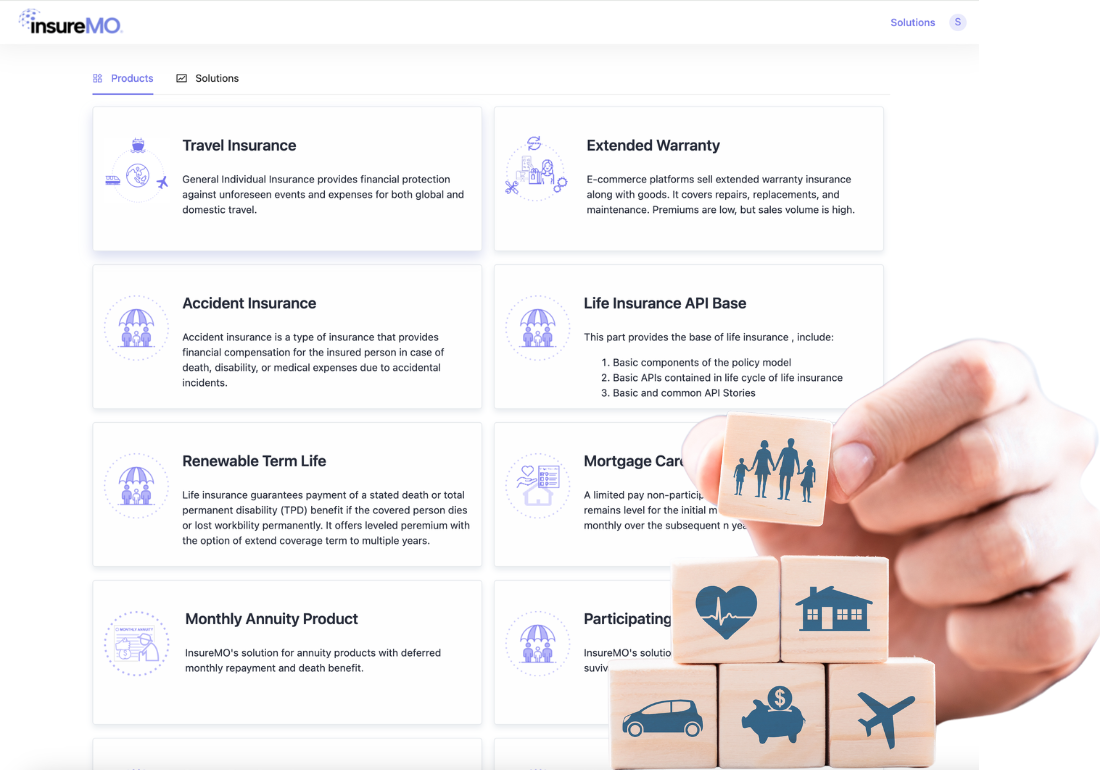

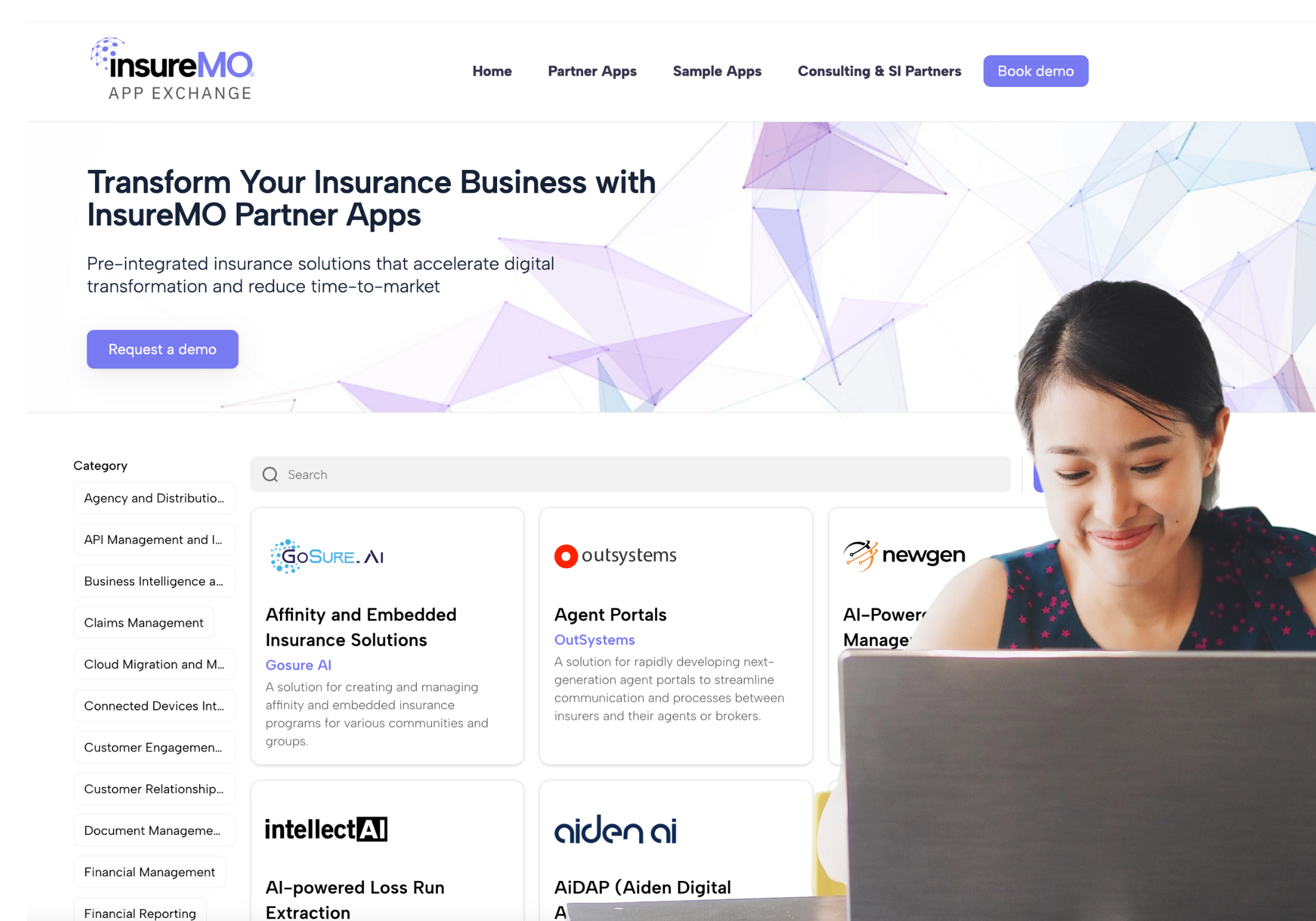

Insurance Product Libraries

Access 17,500+ pre-built insurance products. Customize and launch regionally-tailored offerings quickly.

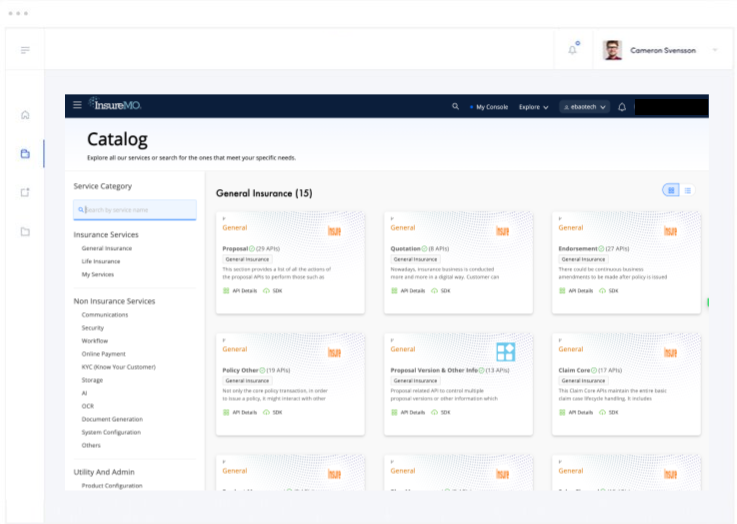

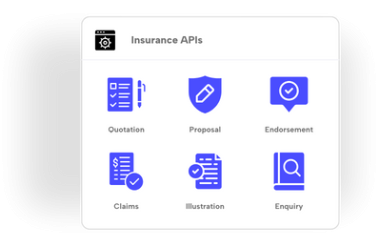

Insurance and Non-Insurance APIs

Utilize 10,000+ APIs supporting full policy lifecycles across life, general, and health insurance sectors.

Admin and Utility

Comprehensive UI-driven platform for effortless creation and management of diverse insurance portfolios

Revolutionize Your Insurance Operations with AI

Discover how to future-proof your business in the age of intelligent automation

Transform Your Insurance Operations with Our Open API Platform

InsureMO helps insurers modernize core systems, enables embedded insurance solutions

Powering Insurance Innovation

A powerful platform with 10,000+ APIs, InsureMO enables core modernization, ecosystem integration, and AI-driven innovation, transforming insurance operations at scale.

Rapid Innovation and Time-to-Market

InsureMO’s extensive library of over 10,000 insurance APIs and 17,500+ ready products enables insurers to launch new offerings in weeks, not months. This accelerates innovation and helps you stay ahead in a competitive market.

Scalable Cloud-Native Architecture

Built on a microservices-based, API-first, cloud-native, and headless (MACH) architecture, InsureMO processes high volumes of transactions with remarkable speed and efficiency. This ensures your solutions can grow seamlessly with your business needs.

Comprehensive Ecosystem Connectivity

InsureMO empowers you to connect with any ecosystem, from Auto & Mobility to Health and Travel. This deep connectivity allows you to create sophisticated insurance offerings for diverse audiences and expand your market reach.