Leveraging Technology and Convergence of Telecommunications and Insurance to Provide Micro-Insurance Solutions in Africa

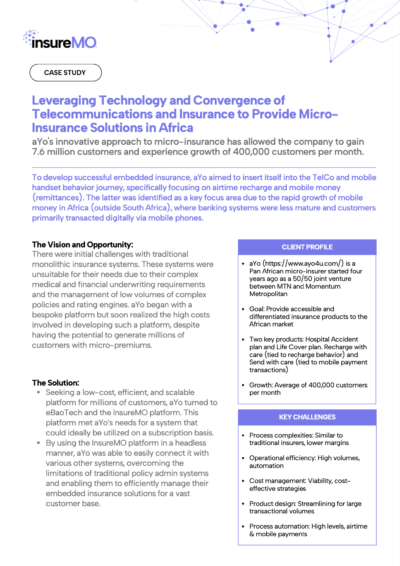

aYo's innovative approach to micro-insurance has allowed the company to gain 7.6 million customers and experience growth of 400,000 customers per month.

To develop successful embedded insurance, aYo aimed to insert itself into the TelCo and mobile handset behavior journey, specifically focusing on airtime recharge and mobile money (remittances). The latter was identified as a key focus area due to the rapid growth of mobile money in Africa (outside South Africa), where banking systems were less mature and customers primarily transacted digitally via mobile phones.

Key Challenges:

There were initial challenges with traditional monolithic insurance systems. These systems were unsuitable for their needs due to their complex medical and financial underwriting requirements and the management of low volumes of complex policies and rating engines. aYo began with a bespoke platform but soon realized the high costs involved in developing such a platform, despite having the potential to generate millions of customers with micro-premiums.

The Solution:

Seeking a low-cost, efficient, and scalable platform for millions of customers, aYo turned to eBaoTech and their InsureMO platform. This platform met aYo’s needs for a system that could ideally be utilized on a subscription basis. By using the InsureMO platform in a headless manner, aYo was able to easily connect it with various other systems, overcoming the limitations of traditional policy admin systems and enabling them to efficiently manage their embedded insurance solutions for a vast customer base.

The Impact:

- Rapid Growth and Expansion Plans

Over the past 5 years, aYo has successfully enrolled 18 million telco customers across just 4 countries. Their strategy for the insurance platform ecosystem involves expanding into more markets where MTN has a presence, ultimately targeting MTN’s 85 million mobile money wallet users. - High-Volume Processing and Flexible Product OfferingsMicroinsurance inherently requires handling an extremely high volume of transactions. Additionally, the low margins per policy necessitate the ability to run pilots to test product performance in specific market segments before committing to a full-scale rollout. This means that aYo needs the flexibility to introduce alternative product constructs at a low cost, quickly, and with variations to meet the demands of each market.