Background and Business Needs:

A Europe-based general insurer provides a wide range of traditional and non-traditional commercial insurance products and risk transfer solutions through a dedicated, global team of commercial insurance experts.

Business drivers:

This general insurer (General Insurer S) saw that small and medium sized enterprises (SME) insurance business has huge growth potential in China. A survey shows that even in the economically developed coastal areas, insurance penetration among Chinese SMEs is less than 5%. The insurer was eager to launch SME lines in China as soon as possible in order to seize the market opportunities.

Challenges:

The typical traditional approach to launch a new business line is either building an end-to-end policy administration system or managing the new LoB in the existing policy admin system. The challenges are 1) Building a new system is time consuming and costly. 2) SME business requires massive engagement from external brokers and allowing brokers access to the back-end core system might create potential security risks and bring performance challenges.

Project Brief:

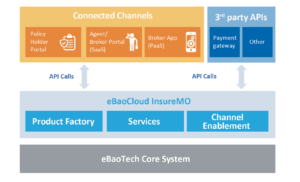

After prudent evaluations, this insurer decided to adopt eBaoCloud InsureMO as a middle office layer on top of their back-end core system to enable the brokerage partners to quote, declaration, cancellation, query, policy holder self-services, etc. After three months development, the new platform was launched in 2018.

This next-generation insurance policy fulfillment platform specially designed for insurance brokers to serve small and medium sized enterprises (SMEs) with the following features:

- Flexible product configuration, supports various types of product packages and tailor-made offerings to specific niche market.

- Customer-centralized platform easily provides client and policy data

- Serve agents and brokers better with improved business and operation processes, with online issuing and evaluation

- Support group insurance business, monthly online registration, real-time policy renewal, and premium auto calculation

Results and Outcomes:

Within three months since the platform has gone live, General Insurer S has launched 6 lines of business and over 60 plans, including employer’s liability, public liability, group PA & TA, fire & consequential loss, construction’s all risks, etc.

- New plan design: 1-3 hours

- New product launch: 1-3 days

- New sales scenario integration: 1-3 weeks

- Update existing products: several minutes

- Better UX: support real time policy update through on-line services: e.g. declaration, cancellation, etc.