The Opportunity:

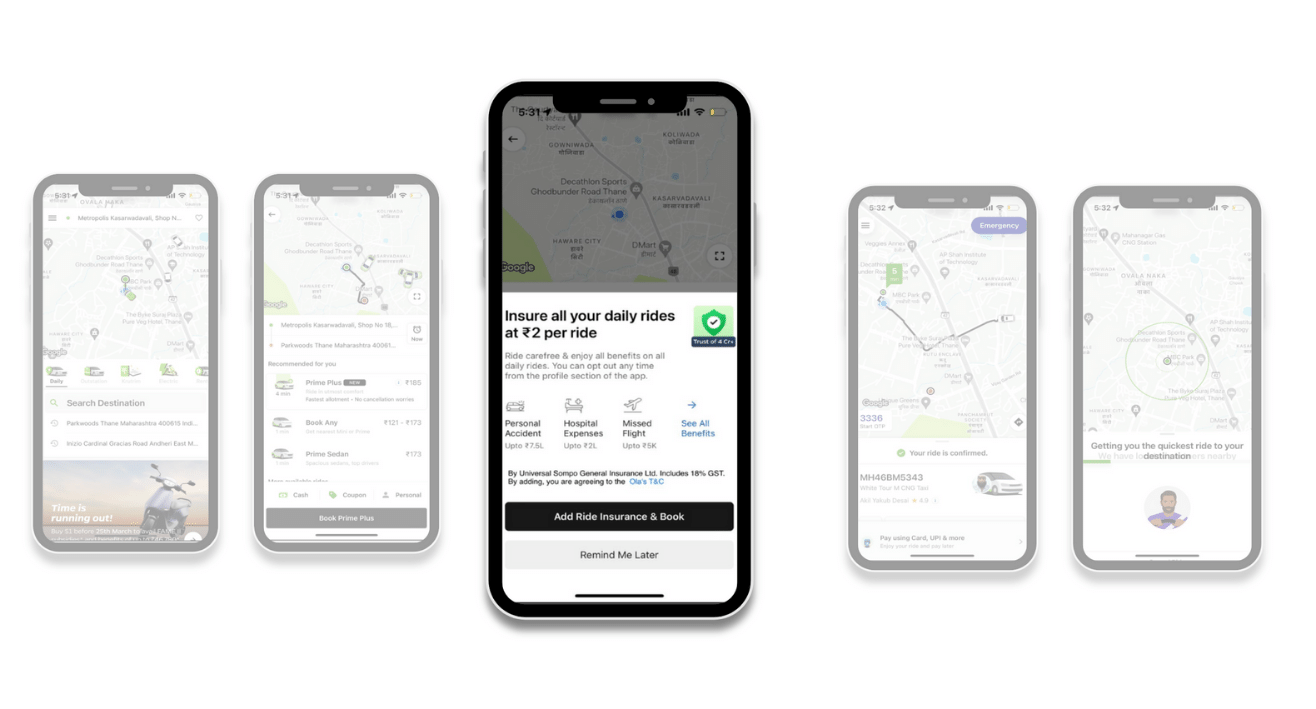

Ola and InsureMO collaborated closely to introduce a revolutionary solution: Customer Trip Insurance, a first-of-its-kind feature in the industry in India which can insure all Ola rides. This groundbreaking offering allows Ola customers to opt for relevant insurance covers tailored to their specific ride types.

For each type of ride, whether it’s a daily commute, a rental, or an outstation trip, riders have the flexibility to select from a range of insurance covers, including:

- Personal Accident

- Medical Evacuation

- Hospitalization due to Injury

- Repatriation of Remains

- Missed Flight (domestic travel)

- Loss of Baggage & personal items

- Fire & burglary at home

InsureMO’s expertise in Variation, Velocity, and Volume played a pivotal role in helping Ola streamline these multiple components into one cohesive product, significantly reducing complexity for end users while ensuring riders have peace of mind throughout their journey.

To ensure maximum coverage, Ola prompts new users during app installation and onboarding to enable Rider Protection. Additionally, relevant notifications are sent over time to remind users to activate their Rider Protection, providing continuous support and guidance.

The impact of this offering has been remarkable, with close to a million policies booked daily on Ola rides. It’s a testament to the trust and value that Ola and InsureMO bring to riders across the country.

Thanks to the collaboration between InsureMO and Ola India, every ride with Ola now comes with customizable insurance options, ensuring unparalleled safety and security for riders.