The 3Vs – Benchmarks raised by Digital business

While Digital channels are offering Insurance companies new venues to improve penetration and also operational efficiencies, on the Enterprise Architecture side it presents a lot of new challenges to the IT support systems. For simplicity, the key needs from IT architecture boils down to the three Vs:

- Variation – Ability to support the exploratory and experimental nature of Digital business while still being cost effective

- Volume – The ability to scale the infrastructure up and down to support sudden spikes that can be caused by Digital sales strategies

- Velocity – Ability to be agile enough to adapt to tap on new Digital avenues before competition catches

While none of these needs may sound as new to the IT Architects, the challenge today is that the benchmarks for these parameters is being set higher and higher with the proliferation of technologyconcepts that have proven to transform other Industries such as Retail and Telecom now entering Insurance. A combination of Microservices + API + Cloud has become synonymous to the 3Vs stated above.

Why does Traditional Architecture inhibit your Digital Mobility?

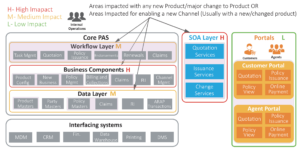

Traditionally, Core Insurance systems have been built on either monolithic or n-tier concept with all the business functions being architected in the same way irrespective of the business agility and extensibility needed in them. Hence, in a typical Enterprise architecture for an Insurance Company, a new product, new channel or major change to an existing product requires a major change to different layers in the architecture. Even, theSOA layer, usually based on coarse-grained Web services needs to change quite a bit to accommodate these.

Hence, the immediate conclusion drawn is that the first step to Being Digital is to “modernize the core”. While there is no denying that it is the need in most Insurance companies across the world, the fact is such large undertakings take a reasonable amount of time and are very risky. Hence, the implementation dilemma becomes if we exhaust our time and resources in modernizing the core (and there is still a chance of failure in it) will we have the time and resources to carry out the real Digital strategy following the core replacement?

This is where the concept of introducing a Middle Office in your enterprise architecture can help. Refer to the thought paper on Middle Office – a “must have” for a Digital Insurer for more understanding of the concept of Middle office in the general business context.

This is where the concept of introducing a Middle Office in your enterprise architecture can help. Refer to the thought paper on Middle Office- a “must have” for a Digital Insurer for more understanding of the concept of Middle office in the general business context.

Enter a Micro-Services/API based Middle Office

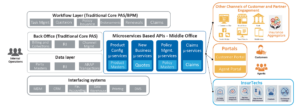

In the Architecture proposed below, we replace the entire Business Logic layer, Data and SOA Layer with a self-contained microservices based Middle Office layer. As an Architecture principle, this layer could only encompass Middle Office functions- which have high interactions with the external world (Channels, Partners, Insureds,Agents).

The introduction of such a Middle Office in the architecture can provide an immediate shot in the hand to an Insurance company’s Digital strategy as well as, in the medium term, pave the way for freedom from the legacy technology that the Insurer has been possibly trying to shut down for ages.

Immediate Impacts of the Middle Office

The following are the key impacts that a Middle Office can create on the Enterprise architecture of an Insurance company:

1.Right Speed for the Right Functions → Agility @ Lower CapEx:

Traditional Monolith systems architecture or even n-tier architecture do not consider the speed of change needed by certain functions v/s the others. It applies the same architecture across all functions making it difficult for every function in the organization to adapt to the speed with which it needs to change.

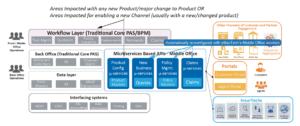

As explained in the exhibit above with the introduction of a Middle Office, the changes for any new product/channel rollout can be limited to:

This is expected as any new product/channel may cause changes to the user journeys. The impacts to this can be reduced by architecting configurable workflows and UIs to adapt quickly to the change

There would be a one-time effort to create or update the product configuration in the middle office layer. Hence, in order to make this product configurator more robust, the eBaoTech Middle Office solution comes with an evolved Product Factory that has been built with eBaoTech’s Core Platform experience in the Life, Health and General business.

With the introduction of a new product, some of the other microservices may have to be enhanced with APIs to support the new product. eBaoTech’s Middle Office solution automates the generation of APIs for these other Middle office function with just the product configuration. Hence, the impact of change to the Middle office layer can also be minimized by usage of an Insurance focused and evolved microservices/APIs platform such as eBaoTech’s InsureMO.

In summary, the Middle Office function, if implemented with the right solution, can achieve quick wins in Digital business at a smaller Capital expenditure.

2. Elasticity and scalability → “High Volume – Low Value” Digital business @ Lower OpEx:

While the earlier section in this document explains how Agility can be achieved at a lower CapEx, in this section we can see how we can keep the OpEx low and yet achieve rapid elasticity in scalability of the Middle Office functions.

For example, an Insurance Company offers a mobile screen Insurance product with the purchase of a mobile on an e-Commerce Store. This site conducts fire-sale events once every quarter for their mobile consumers. With each sale season, the volume of quotations and policies issued by the Insurance company also spike to about 10 times the usual volume.

In a traditional web-service based SOA architecture, this would mean that you either build your SOA layer on a high-performance infrastructure for the entire year or you are limited to keep the volumes to what your existing infrastructure can support. Hence, in short, your infrastructure scalability is not as elastic as your seasonal demands.

Here is where implementing the Middle Office on a scalable infrastructure that can scale as elastically as your demand can help. Technically speaking, implementing the Middle Office microservices in a containerized cloud environment can offer the Middle Office functions rapid scalability to meet the high-volume business for a short period of time based leveraging the elasticity and scalability capabilities provided by the Cloud platform.

Medium Term Impacts of the Middle Office

The Middle Office should not be looked upon as a “patch” solution that can complicate your Enterprise architecture for a short-term win. If fitted into a well-crafted architecture transformation strategy, it can serve to be pedestal to an enterprise architecture that Insurance companies have always wanted. Hence, once introduced, the Middle Office can create the following more far-reaching impacts:

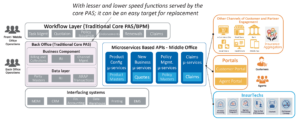

1. Lighter Core → Lesser Maintenance for Legacy or Easy exit from Legacy:

Once the new Middle Office layer is capable of handling all the middle office functions for the Insurance company, the scope of what the Core PAS solution delivers to the overall architecture becomes smaller.

Hence, over a medium term of Middle Office implementation, Insurers can either save on the costly enhancements they would have to do on their Legacy systems to even run BAU or even think of a replacement option.

2. Participation in the Larger API Economy → Tapping into Innovations in Insurance:

The API economy has the potential to rapidly change the business model of the Insurance Industry just like it has done in Industries such as Retail (Amazon), Social Media (FaceBook), Entertainment (Netflix) and many more.

The digitally savvy customers today do not compare the mobile applications or portals or any customer touchpoints of an Insurer to another Insurer, but they do compare them to the Amazons and Googles of the world. Hence, in the Digital world, an Insurance company will continue to be pushed to innovate further with the emergence of new innovations brought in by start-ups and InsurTechs.

Moving the Middle Office functions to a microservice based API architecture, Insurance companies can surely adapt to the ever-evolving industry. With this vision in mind, eBaoTech’s Middle Office platform also serves as an API Marketplace for Insurance Companies, Aggregators, InsureTech and tech start-ups alike.

In Summary – Still thinking of Core PAS replacement as the only option being Digital ready?

This paper attempts to prompt the CDOs, CIOs and Enterprise Architects to rethink on the option of Core PAS replacement as the only option to moving towards a Digital Enterprise. While the option is not wrong, the time to reach your target and the cost of failure attached to it is too high.

A Middle Office architecture, as explained in this paper also needs a well charted roadmap to reach the target. However, the horizons for success are nearer, benefits achieved sooner can fund the remainder of the transformation. The cost of failure, if any, is also lower in this case. Hence, with a mature solution in this space, eBaoTech’s InsureMO platform, with a proven track record, rethinking the Middle Office way of Digital Transformation is essential.

- For an understanding of why Digital Insurance needs a middle office read our other thought paper – Middle Office – a “must have” for a Digital Insurer

- For recent digital success stories with eBaoTech’s Insure MO: