Create & Connect

InsureMO is accelerating insurance success for

ecosystems with unmatched speed, choice, and scale

0B$

GWP Processed p.a.

0+

SKUs in our Product Library

0+

Insurance &

Non-Insurance API’s

Non-Insurance API’s

0

Countries

Transform Your Bancassurance Strategy with InsureMO

Unlocking new opportunities for banks and insurers alike.

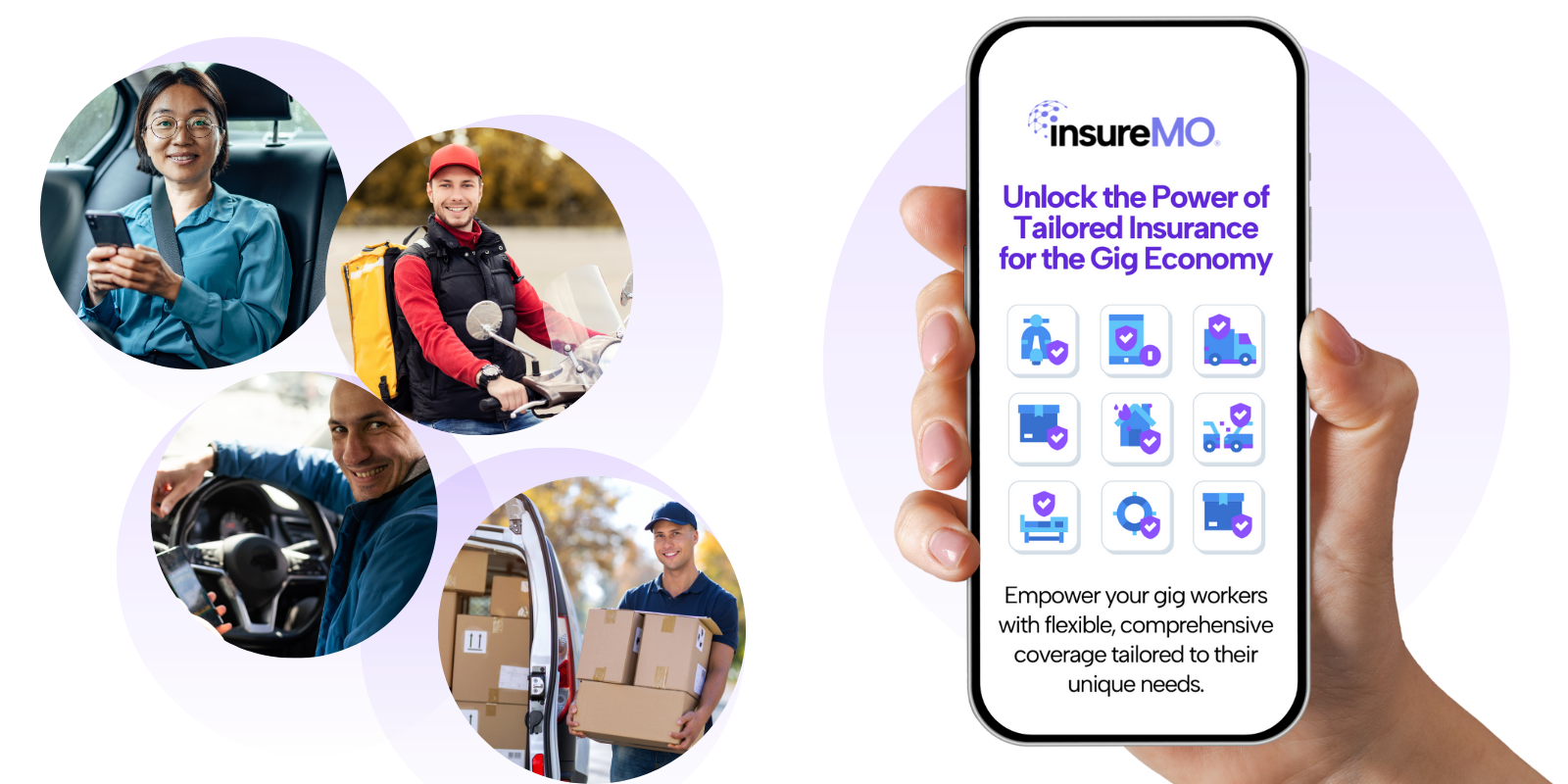

Empower Your Gig Platform with Comprehensive Insurance Offerings

InsureMO enables gig platforms to offer comprehensive insurance and protection to both gig customers and workers, enhancing trust, confidence, and growth within the gig economy ecosystem.

InsureMO offers the easiest way to launch and manage insurance solutions for the gig economy

InsureMO's API-first, end-to-end insurance platform powers digital insurance and omni-channel distribution for any ecosystem

Your Fast-Track to Insurance Success in the Gig Economy

Launch and scale your gig economy platform's insurance offerings

with InsureMO's extensive product range, rapid creation, and vast connectivity.

Comprehensive Product Library

Access 40+ LOBs, 5,000+ SKUs across Health, Life, and General Insurance to meet your users' needs.

Rapid Product Creation for Your Platform

Launch new products in <1 week, variations in 3 days. Stay agile and competitive.

Enabling fast innovation and deep connectivity through consumable components and assets

A comprehensive library of ready-to-use insurance components, APIs, and microservices, empowering you to quickly create and deploy innovative insurance solutions

Empowering businesses with a highly elastic and auto-scalable platform architecture

InsureMO's elastic and auto-scalable platform architecture enables your business to efficiently handle dynamic demand and grow without infrastructure constraints.

Enable seamless integration with a vast network of distribution channels

The platform collaborates with over 6,000 distribution channels, including auto & mobility, banks, payments and fintechs, health, travel, pet care, telecom, brokers & agents, SMB, and gig economy.

Drive extra revenue streams and customer insights through embedded insurance

With InsureMO, you can empower your distribution channels to embed insurance, drive revenue, enhance experiences, and gather insights for personalized solutions and growth.